compare online trading account

In today's digital era, online trading has become a popular avenue for investing and growing wealth. With numerous online trading accounts available, it's essential to choose the right one that suits your needs and goals. This comprehensive guide aims to assist you in comparing different online trading account options, enabling you to make an informed decision.

Understanding Online Trading Accounts

Online trading accounts serve as a gateway to the financial markets, allowing individuals to buy and sell securities. They provide access to various investment options, such as stocks, bonds, mutual funds, ETFs, and more. Understanding the different types of online trading accounts is crucial in selecting the one that aligns with your investment objectives.

Individual Brokerage Accounts

An individual brokerage account is the most common type of online trading account. It allows individuals to buy and sell securities in their own name. With an individual brokerage account, you have full control over your investment decisions and can customize your portfolio based on your risk tolerance and investment goals.

Retirement Accounts

Retirement accounts, such as Traditional IRAs, Roth IRAs, and 401(k)s, are specifically designed to help individuals save for retirement. These accounts offer tax advantages, such as tax-deferred or tax-free growth, depending on the account type. When comparing online trading accounts, consider whether they provide retirement account options if you are looking to save for your future.

Margin Accounts

Margin accounts allow traders to borrow funds from their broker to invest in securities. With a margin account, you can amplify your buying power and potentially increase your returns. However, it's important to note that margin trading involves higher risks and should only be undertaken by experienced investors who can manage the potential losses.

When comparing online trading accounts, consider the type of account that suits your investment needs. If you prefer more control and flexibility, an individual brokerage account may be the right choice. If retirement savings are your priority, look for accounts that offer retirement account options. For those interested in margin trading, seek online brokers that provide margin account services.

Evaluating Fees and Commissions

Fees and commissions can significantly impact your trading experience and overall profitability. Before opening an online trading account, it's important to understand the fee structures imposed by different brokers and compare them to find the most cost-effective option for your investment needs.

Account Maintenance Fees

Some online trading accounts charge account maintenance fees, which are recurring charges for maintaining your account. These fees may be charged monthly, quarterly, or annually. When comparing online trading accounts, consider whether they impose account maintenance fees and how they may affect your overall investment returns.

Trading Fees

Trading fees are charges incurred when buying or selling securities. They can be in the form of a flat fee per trade or a percentage of the trade value. Online brokers may have different fee structures, so it's important to compare the trading fees of different accounts to find the most cost-effective option for your trading frequency and investment size.

Commission Rates

Commission rates are charges imposed by online brokers for executing trades on your behalf. Some brokers offer commission-free trading for certain securities, while others have fixed or variable commission rates. When comparing online trading accounts, consider the commission rates for the types of securities you plan to trade and assess how they may impact your trading costs.

In addition to account maintenance fees, trading fees, and commission rates, be sure to also consider other potential charges, such as inactivity fees, withdrawal fees, and transfer fees. By carefully evaluating the fee structures of different online trading accounts, you can minimize costs and maximize your investment returns.

Analyzing Trading Tools and Platforms

The trading tools and platforms provided by online trading accounts play a crucial role in executing trades effectively and efficiently. When comparing accounts, consider the features and functionality of their trading tools and platforms to ensure they meet your trading needs.

Real-Time Market Data

Real-time market data is essential for making informed trading decisions. Look for online trading accounts that provide real-time streaming quotes, market news, and research reports. Having access to up-to-date information allows you to react quickly to market changes and seize investment opportunities.

Charting Tools

Charting tools help traders analyze price patterns and trends. Look for online trading accounts that offer advanced charting capabilities, including various technical indicators, drawing tools, and customization options. Robust charting tools can enhance your technical analysis and improve your trading strategies.

Order Types

Different trading strategies require different order types. When comparing online trading accounts, consider whether they offer a variety of order types, such as market orders, limit orders, stop orders, and trailing stop orders. Having access to a wide range of order types allows you to execute trades based on your desired entry and exit points.

Mobile Accessibility

In today's fast-paced world, mobile accessibility is essential for on-the-go trading. Look for online trading accounts that provide mobile apps compatible with your smartphone or tablet. A user-friendly mobile app with essential trading features allows you to monitor your portfolio, execute trades, and stay informed about market developments, even when you're away from your computer.

By carefully analyzing the trading tools and platforms offered by different online trading accounts, you can ensure that they align with your trading strategies and preferences. Consider your trading style, the level of advanced features you require, and the importance of mobile accessibility in making your decision.

Examining Account Options and Investment Choices

Not all online trading accounts provide the same range of investment options. When comparing accounts, consider the variety of investment choices they offer to determine whether they align with your investment goals and strategy.

Stocks

Stocks are one of the most common investment options available through online trading accounts. Look for accounts that provide access to a wide range of stocks, including domestic and international companies across various sectors. The ability to invest in individual stocks allows you to build a diversified portfolio and potentially benefit from the growth of specific companies.

Bonds

Bonds are fixed-income securities that provide regular interest payments. If you're interested in income-generating investments or want to diversify your portfolio, look for online trading accounts that offer a variety of bonds, including government bonds, corporate bonds, and municipal bonds. The availability of different bond types allows you to tailor your fixed-income investments to your risk tolerance and income objectives.

ETFs and Mutual Funds

ETFs (Exchange-Traded Funds) and mutual funds are investment vehicles that allow you to invest in a diversified portfolio of securities. They offer exposure to various asset classes, such as stocks, bonds, commodities, and more. Look for online trading accounts that provide a wide selection of ETFs and mutual funds, allowing you to create a diversified investment portfolio with ease.

Options

Options are derivative contracts that give you the right to buy or sell an underlying asset at a predetermined price within a specific time frame. If you're interested in options trading, it's important to choose an online trading account that offers options trading capabilities. Look for accounts that provide access to a variety of options contracts and have robust options trading tools to support your strategies.

When comparing online trading accounts, carefully assess the investment choices they offer and ensure they align with your investment objectives. Consider the availability of stocks, bonds, ETFs, mutual funds, options, and any other specific investment options that are important to you.

Considering Customer Support and Resources

Having access to reliable customer support and educational resources can greatly enhance your trading experience. When comparing online trading accounts, consider the level of customer support and educational resources provided by different brokers.

Customer Support Channels

Look for online trading accounts that offer multiple customer support channels, such as live chat, phone support, and email support. Having various options to reach out to customer support ensures that you can easily seek assistance whenever you encounter issues or have questions about your account or trades.

Educational Materials

Educational materials, such as tutorials, articles, videos, and webinars, can help you enhance your trading knowledge and skills. Look for online trading accounts that provide comprehensive educational resources to support your learning journey. Access to educational materials can empower you to make informed investment decisions and improve your trading strategies.

Research Reports and Analysis

Research reports and analysis from reputable sources can provide valuable insights into market trends and investment opportunities. Some online trading accounts offer their own research reports and analysis, while others provide access to third-party research. Consider whether the account provides research reports and analysis that align with your investment needs and preferences.

By considering the customer support channels, educational materials, and research reports offered by different online trading accounts, you can ensure that you have the necessary support and resources to navigate the financial markets effectively.

Assessing Security Measures

Security is of utmost importance when it comes to online trading accounts. When comparing accounts, it's crucial to assess the security measures implemented by different brokers to protect your personal and financial information.

Encryption Protocols

Look for online trading accounts that utilize robust encryption protocols to secure your dataand communications. Encryption protocols, such as Secure Socket Layer (SSL) technology, ensure that your sensitive information is transmitted securely over the internet. This helps protect your account details and prevents unauthorized access to your trading account.

Two-Factor Authentication

Two-factor authentication adds an extra layer of security to your online trading account. It requires you to provide a second form of verification, such as a unique code sent to your mobile device, in addition to your username and password. This helps prevent unauthorized access even if someone obtains your login credentials.

Account Protection Policies

Look for online trading accounts that have robust account protection policies in place. These may include features such as automatic logouts after a period of inactivity, strong password requirements, and the ability to set up security alerts for suspicious activities. Account protection policies help ensure that your trading account remains secure at all times.

Regulatory Compliance

Regulatory compliance is vital to ensure the safety of your funds and investments. Online trading accounts should operate under the oversight and regulations of relevant regulatory bodies. Research the regulatory compliance of different brokers and ensure they adhere to the necessary rules and regulations to protect your rights as an investor.

By assessing the security measures implemented by different online trading accounts, you can choose an account that prioritizes the safety of your personal and financial information, giving you peace of mind when conducting trades and managing your investments.

Comparing Account Minimums and Initial Deposits

Some online trading accounts require a minimum deposit to open an account, while others have no minimums. When comparing accounts, it's important to consider the account minimums and initial deposit requirements, as they can vary significantly.

Account Minimums

Account minimums refer to the minimum amount of funds required to open an online trading account. Some brokers have high minimums, which may be more suitable for experienced or high-net-worth investors. Others have low or no minimums, making them accessible to a broader range of investors. Consider your budget and investment goals when assessing the account minimums of different brokers.

Initial Deposits

Initial deposits are the funds you need to deposit into your trading account when you first open it. Brokers may have different initial deposit requirements, ranging from a few hundred to several thousand dollars. Assess your financial situation and determine the amount you are comfortable depositing as an initial investment.

When comparing online trading accounts, choose one that aligns with your budget and investment goals. If you have a smaller budget, look for accounts with low or no minimums and lower initial deposit requirements. If you have a larger budget or are looking for specialized services, high minimums may be acceptable.

Reviewing Account Accessibility and User Experience

Account accessibility and user experience are key factors to consider for a seamless and enjoyable trading experience. When comparing online trading accounts, assess the accessibility and user experience they offer to ensure they meet your needs and preferences.

Website and Mobile App Functionality

The website and mobile app functionality of an online trading account should be user-friendly and intuitive. Look for accounts that have well-designed platforms with easy navigation, clear trade execution, and comprehensive account management tools. The platform should provide a smooth experience, allowing you to efficiently manage your trades and monitor your portfolio.

Trading Speed and Execution

Fast and reliable trade execution is essential for successful online trading. Look for accounts with robust infrastructure and advanced technology that can handle high trade volumes without delays or system crashes. Ensure that the online trading account you choose can execute trades quickly and accurately, enabling you to take advantage of market opportunities.

Account Management Tools

Comprehensive account management tools are beneficial for monitoring your portfolio, accessing statements and trade confirmations, and managing your account settings. Look for online trading accounts that provide a range of account management tools, such as customizable dashboards, performance reports, and tax reporting features. These tools enhance your ability to stay organized and make informed decisions.

Research and News Integration

Integrating research and news into the trading platform can provide valuable insights and help you stay informed about market developments. Look for online trading accounts that offer research reports, market news, and analysis directly within their platform. This integration allows you to access relevant information without switching between multiple sources, saving you time and improving your trading decisions.

By reviewing the account accessibility and user experience of different online trading accounts, you can select an account that offers a platform and tools that are intuitive, efficient, and cater to your trading preferences.

Understanding Regulatory Compliance

Regulatory compliance ensures that online trading accounts operate within legal frameworks, protecting your rights as an investor. It's crucial to understand the regulatory bodies and requirements that online brokers must adhere to when comparing accounts.

Securities and Exchange Commission (SEC)

The Securities and Exchange Commission (SEC) is a regulatory body responsible for overseeing the securities industry in the United States. Brokers offering online trading accounts must comply with SEC regulations to protect investors and ensure fair and transparent markets. Research whether the brokers you are considering are registered with the SEC and operate under its guidelines.

Financial Industry Regulatory Authority (FINRA)

The Financial Industry Regulatory Authority (FINRA) is a self-regulatory organization that oversees brokerage firms and registered brokers in the United States. FINRA sets rules and standards for securities industry professionals and ensures compliance with securities regulations. Check whether the brokers you are considering are members of FINRA and adhere to its guidelines.

Other Regulatory Bodies

In addition to the SEC and FINRA, there may be other regulatory bodies specific to your country or region. Research the regulatory landscape and identify the relevant regulatory bodies that oversee online trading accounts. Ensure that the brokers you are considering operate under the appropriate oversight and comply with the necessary regulations.

Understanding regulatory compliance is essential to ensure the safety and legitimacy of the online trading accounts you are considering. By choosing an account that operates within legal frameworks and adheres to regulatory requirements, you can have confidence in the integrity of your investments.

Reading User Reviews and Ratings

User reviews and ratings provide valuable insights into the experiences of other traders. When comparing online trading accounts, it's important to read user reviews and ratings to gather information and opinions from real-life users.

Platforms for User Reviews

There are various platforms where users can leave reviews and ratings for online trading accounts. Look for reputable platforms that provide a wide range of user reviews, such as independent review websites, forums, or social media groups dedicated to trading. These platforms often offer unbiased and authentic user experiences.

Analysis of User Feedback

When reading user reviews, it's important to analyze the feedback critically. Look for common themes or patterns in the reviews to identify both positive and negative aspects of the online trading accounts. Consider the credibility of the reviewers and weigh their experiences against your own preferences and requirements.

Consideration of Overall Reputation

Take into account the overall reputation of the online trading accounts you are considering. Look for brokers with a positive track record and a strong reputation in the industry. Consider factors such as their longevity, client base, and any accolades or awards they have received. A reputable broker with positive user reviews and ratings is more likely to provide a satisfactory trading experience.

Reading user reviews and ratings can provide valuable insights and help you gauge the reputation and user satisfaction of different online trading accounts. While individual experiences may vary, considering the overall sentiment and feedback can assist you in making an informed decision.

Choosing the right online trading account is a crucial step towards achieving your investment goals. By comparing various aspects such as fees, trading tools, investment options, customer support, security measures, user experience, regulatory compliance, and user reviews, you can find an account that aligns with your needs and preferences. Remember to conduct thorough research, consider your investment objectives and risk tolerance, and weigh the pros and cons of each account. Armed with the information provided in this comprehensive guide, you are well-equipped to embark on your online trading journey with confidence.

Related video of Compare Online Trading Account: A Detailed Guide to Choosing the Right Option

uk online stock trading

Are you eager to dive into the exciting world of online stock trading in the UK? From the comfort of your own home, you can participate in the dynamic financial markets and potentially earn significant profits. However, before jumping in, it's crucial to understand the ins and outs of this investment method. In this comprehensive guide, we will walk you through the essentials of UK online stock trading, providing you with the knowledge and tools necessary to get started.

In this article, we will cover a wide range of topics, including choosing the right online trading platform, understanding different types of stocks, conducting fundamental and technical analysis, managing risk, and executing trades. Whether you are a complete beginner or have some trading experience, this guide will equip you with the necessary information to navigate the stock market with confidence.

Understanding Online Stock Trading

Online stock trading has revolutionized the way individuals invest in the UK. Traditionally, investors had to rely on brokers to execute trades on their behalf. However, with the advent of online trading platforms, investors can now directly access the stock market and place trades at their convenience. This accessibility has opened up a world of opportunities for individuals to participate in the financial markets.

The Benefits of Online Stock Trading

There are several advantages to trading stocks online. Firstly, it provides investors with greater control over their investments. With online platforms, you can monitor your portfolio in real-time, access a wealth of financial information, and execute trades instantly. This level of control allows you to react quickly to market movements and take advantage of profitable opportunities.

Secondly, online stock trading offers lower costs compared to traditional brokerage services. Many online platforms charge significantly lower commissions and fees, enabling investors to maximize their returns. Additionally, online platforms often provide tools and resources for free, such as educational materials, research reports, and technical analysis charts.

The Risks of Online Stock Trading

While online stock trading offers numerous benefits, it is important to be aware of the associated risks. One of the primary risks is market volatility. Stock prices can fluctuate rapidly, and if you make impulsive decisions without proper research and analysis, you may incur significant losses. It is crucial to have a disciplined approach to trading and to carefully consider your investment decisions.

Another risk is the potential for technical issues or system failures with online trading platforms. While rare, these issues can disrupt your ability to execute trades or access your account. It is essential to choose a reputable platform with reliable technology infrastructure and robust customer support to minimize the risk of such disruptions.

Choosing the Right Online Trading Platform

Choosing the right online trading platform is a critical step in your stock trading journey. With numerous options available, it can be overwhelming to make the right choice. Here are some key factors to consider when selecting a platform:

1. Fees and Commissions

One of the most important considerations is the cost structure of the platform. Different platforms have varying fee models, including commission-based or fee-based structures. It is crucial to assess the costs associated with trading, such as commissions, account maintenance fees, and transaction charges. Consider your trading frequency and volume to determine which fee structure aligns with your trading style.

2. User Interface and Trading Tools

Another vital aspect is the user interface and trading tools provided by the platform. A user-friendly interface with intuitive navigation can significantly enhance your trading experience. Look for platforms that offer advanced charting tools, real-time market data, and customizable trading screens. These features can facilitate better analysis and decision-making.

3. Research and Educational Resources

Access to comprehensive research and educational resources is invaluable for traders, especially beginners. Look for platforms that provide fundamental and technical analysis reports, company profiles, and educational materials. These resources can help you make informed investment decisions and improve your trading skills.

4. Customer Support

Reliable customer support is crucial when dealing with any online platform. Ensure that the trading platform offers timely and efficient customer support channels, such as phone, email, or live chat. This ensures that you can quickly resolve any issues or inquiries that may arise during your trading journey.

Understanding Different Types of Stocks

Before you start trading stocks, it is essential to understand the different types of stocks available in the market. Here are some key categories:

1. Common Stocks

Common stocks are the most prevalent type of stock that individuals trade. When you purchase common stocks, you become a partial owner of the company and have the right to vote on corporate matters. Common stockholders also have the potential to receive dividends if the company distributes profits to shareholders.

2. Preferred Stocks

Preferred stocks are a class of stock that typically provides shareholders with a higher claim on company assets and earnings compared to common stockholders. Preferred stockholders have priority when it comes to receiving dividends and may have certain additional rights, such as the ability to convert their shares into common stock.

3. Growth Stocks

Growth stocks belong to companies that are expected to grow at an above-average rate compared to other companies in the market. These stocks typically reinvest their earnings into the business rather than distributing dividends. Investors who are willing to take on more risk in exchange for potential capital appreciation often invest in growth stocks.

4. Value Stocks

Value stocks are stocks that are considered undervalued by the market. These stocks are believed to be trading at prices lower than their intrinsic value. Investors who follow a value investing strategy look for companies with strong fundamentals and relatively low stock prices, anticipating that the market will eventually recognize the true value of these stocks.

5. Dividend Stocks

Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders in the form of dividends. These stocks are popular among income-seeking investors who prioritize a steady stream of passive income. Dividend stocks can provide a reliable source of cash flow, especially in uncertain market conditions.

Fundamental Analysis: Evaluating Company Performance

Understanding fundamental analysis is essential for assessing a company's financial performance and making informed investment decisions. Here are the key aspects to consider:

1. Financial Statements

Financial statements, including the balance sheet, income statement, and cash flow statement, provide valuable insights into a company's financial health. Analyzing these statements allows you to evaluate the company's assets, liabilities, revenue, expenses, and cash flow patterns. Look for consistent growth in revenue and earnings, a healthy balance sheet, and positive cash flow trends.

2. Ratios and Metrics

Financial ratios and metrics help investors assess a company's efficiency, profitability, and leverage. Common ratios include the price-to-earnings (P/E) ratio, earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio. These ratios provide a snapshot of the company's financial position and can be compared to industry averages or historical data to identify trends.

3. Company Management

Examining the company's management team and their track record is crucial. Evaluate the experience and expertise of the executives, their strategic vision, and their ability to execute plans. A strong management team with a proven track record can provide confidence in the company's ability to navigate challenges and create value for shareholders.

4. Industry Analysis

Understanding the industry in which a company operates is vital. Analyze the competitive landscape, market trends, and potential risks associated with the industry. Consider factors such as technological advancements, regulatory changes, and market demand. A thorough industry analysis can help you assess the company's competitive position and growth potential.

Technical Analysis: Unveiling Stock Market Patterns

Technical analysis involves evaluating historical price and volume data to identify patterns and trends in stock prices. Here are the key elements of technical analysis:

1. Chart Patterns

Chart patterns, such as support and resistance levels, trend lines, and reversal patterns, provide insights into the psychology of market participants. Patterns like double tops, head and shoulders, and flags can indicate potential price reversals or continuations. Learning to recognize these patterns can help you make more effective trading decisions.

2. Indicators

Technical indicators are mathematical calculations based on price and volume data. They help traders identify potential entry and exit points. Common indicators include moving averages, relative strength index (RSI), and MACD (moving average convergence divergence). These indicators provide additional insights into market trends and momentum.

3. Candlestick Analysis

Candlestick charts are a popular tool used in technical analysis. They provide information about the opening, closing, high, and low prices within a specific time period. Candlestick patterns, such as doji, hammer, and engulfing patterns, can indicate potential reversals or continuation of trends. Learning to interpret candlestick patterns can enhance your understanding of market sentiment.

4. Volume Analysis

Volume is a crucial component of technical analysis. It represents the number of shares traded during a given period. Analyzing volume can help confirm the strength of price movements. High volume during price increases suggests bullish sentiment, while high volume during price decreases signals bearishsentiment. Volume analysis is often used in conjunction with other technical indicators to validate trading signals.

Risk Management: Protecting Your Capital

Managing risk is a fundamental aspect of successful stock trading. Here are some key strategies to protect your capital:

1. Setting Stop-Loss Orders

A stop-loss order is an instruction to sell a stock if it reaches a specific price level. By setting a stop-loss order, you can limit your potential losses if a trade moves against you. It is important to determine an appropriate stop-loss level based on your risk tolerance and the volatility of the stock.

2. Diversifying Your Portfolio

Diversification involves spreading your investments across different stocks, sectors, and asset classes. By diversifying your portfolio, you reduce the impact of any single investment on your overall portfolio performance. This strategy helps mitigate the risk of significant losses from a single stock or sector downturn.

3. Position Sizing

Position sizing refers to determining the appropriate amount of capital to allocate to each trade. It involves considering factors such as the risk-reward ratio, stop-loss level, and overall portfolio diversification. By properly sizing your positions, you can limit the potential impact of any single trade on your overall portfolio performance.

4. Risk/Reward Analysis

Before entering a trade, it is crucial to assess the potential risk and reward. A favorable risk/reward ratio means that the potential reward of a trade outweighs the potential risk. By identifying trades with a positive risk/reward ratio, you increase the probability of profitable trades over the long term.

5. Psychological Discipline

Psychological discipline is essential for effective risk management. It involves controlling emotions such as fear and greed that can lead to impulsive and irrational trading decisions. By maintaining discipline and sticking to your trading plan, you can avoid making emotional decisions that may result in unnecessary losses.

Placing Trades: How to Execute Your Trading Strategy

Once you have conducted your analysis and developed a trading strategy, it is time to execute your trades. Here are the key steps to placing trades:

1. Choosing the Order Type

There are different order types you can use to execute your trades. Market orders are executed at the prevailing market price, while limit orders allow you to set a specific price at which you are willing to buy or sell. Stop orders are triggered when the stock reaches a specified price, and stop-limit orders combine elements of both stop and limit orders.

2. Selecting the Trade Size

Determine the appropriate trade size based on your risk tolerance, available capital, and position sizing strategy. Consider the potential impact of the trade on your overall portfolio and ensure that the trade size aligns with your risk management goals.

3. Reviewing and Confirming the Trade

Before executing the trade, carefully review the order details, including the stock symbol, order type, quantity, and price. Double-check that the information is accurate, and confirm the trade to ensure it is executed as intended.

4. Monitoring the Trade

After placing the trade, it is important to monitor its progress. Keep an eye on the stock price, market conditions, and any relevant news or events that may impact the trade. Depending on your trading strategy, you may need to adjust your stop-loss or take-profit levels as the trade progresses.

Tracking Your Portfolio: Managing Your Investments

Effectively tracking and managing your investments is crucial for long-term success. Here are some key considerations:

1. Utilizing Portfolio Tracking Tools

Many online trading platforms offer portfolio tracking tools that allow you to monitor your investments in real-time. These tools provide valuable insights into your portfolio's performance, including profit and loss, asset allocation, and historical performance. Utilize these tools to gain a comprehensive view of your investments.

2. Analyzing Performance Metrics

Regularly analyze performance metrics, such as return on investment (ROI), to assess the overall success of your portfolio. Compare your portfolio's performance to relevant benchmarks or indices to gain a broader perspective. Identify areas of strength and weakness to refine your investment strategy.

3. Rebalancing Your Portfolio

Periodically rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalancing involves adjusting the asset allocation by buying or selling assets to bring it back to the desired target. This strategy helps maintain diversification and manage risk.

4. Staying Informed

Stay informed about market trends, economic news, and company-specific developments that may impact your portfolio. Regularly review financial news, research reports, and company announcements to make informed decisions regarding your investments.

Advanced Trading Strategies: Taking Your Skills to the Next Level

Once you have mastered the basics of stock trading, you may be interested in exploring more advanced trading strategies. Here are some popular techniques:

1. Swing Trading

Swing trading involves taking advantage of short- to medium-term price fluctuations in stocks. Traders aim to capture short-term trends and typically hold positions for a few days to several weeks. Swing trading requires technical analysis skills and the ability to identify potential reversals or breakouts.

2. Day Trading

Day trading involves executing trades within a single trading day. Day traders aim to profit from intraday price movements and close all positions before the market closes. Day trading requires fast decision-making, discipline, and the ability to manage risk in a short time frame.

3. Options Trading

Options trading involves trading options contracts, which provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific period. Options can be used for hedging, speculation, or generating income. Options trading requires a deep understanding of options strategies and their associated risks.

4. Algorithmic Trading

Algorithmic trading involves using computer algorithms to execute trades based on predefined rules and parameters. This method utilizes automated trading systems to enter and exit positions based on technical indicators or other criteria. Algorithmic trading requires programming skills and a solid understanding of market dynamics.

Continuous Learning: Resources for Ongoing Education

Stock trading is a constantly evolving field, and continuous learning is essential for staying ahead. Here are some resources to further expand your knowledge:

1. Books and E-books

There are numerous books and e-books available on stock trading that cover a wide range of topics, from beginner guides to advanced strategies. Look for reputable authors and books that align with your trading style and goals.

2. Online Courses and Webinars

Online courses and webinars provide structured learning experiences and the opportunity to interact with industry professionals. Many platforms offer comprehensive courses on stock trading, technical analysis, and other related topics.

3. Financial News and Websites

Stay updated with financial news and visit reputable websites that provide up-to-date information on stock market trends, company news, and economic developments. Explore financial news outlets, stock market websites, and financial blogs to broaden your knowledge.

4. Trading Simulators

Trading simulators allow you to practice trading without risking real money. These platforms provide a simulated trading environment where you can execute trades and test different strategies. Utilize trading simulators to gain hands-on experience and refine your trading skills.

Now that you have a comprehensive understanding of UK online stock trading, you are ready to embark on your trading journey. Remember, practice, patience, and continuous learning are key to becoming a successful trader. So, equip yourself with the right knowledge, make strategic decisions, and enjoy the rewarding experience of trading in the UK stock market.

Related video of UK Online Stock Trading: A Comprehensive Guide for Beginners

iq option trading platform

When it comes to online trading platforms, IQ Option stands out as a reliable and user-friendly option for both beginners and experienced traders. With its extensive range of features and tools, IQ Option offers a seamless trading experience across various financial markets. In this comprehensive guide, we will delve into the intricacies of the IQ Option trading platform, providing you with all the essential information you need to know to make informed trading decisions.

Section 1: Understanding the Basics of IQ Option

IQ Option is a leading online trading platform that was established in 2013. Since its inception, it has gained a strong reputation for its user-friendly interface, advanced features, and commitment to providing a secure trading environment. The platform is operated by IQ Option Ltd, a company based in Cyprus, and is regulated by the Cyprus Securities and Exchange Commission (CySEC).

A Trusted and Regulated Platform

Regulation is an important factor to consider when choosing a trading platform, as it ensures that the platform operates in a fair and transparent manner and that customer funds are protected. IQ Option is regulated by CySEC under license number 247/14, which means that it adheres to strict regulatory guidelines and undergoes regular audits to ensure compliance.

Opening an account with IQ Option is a straightforward process. Simply visit the IQ Option website and click on the 'Sign Up' button. You will then be prompted to enter your personal details, such as your name, email address, and phone number. Once you have completed the registration process, you can proceed to verify your account by providing the necessary documents, such as a copy of your ID or passport and proof of address.

An Intuitive User Interface

The IQ Option trading platform features a user-friendly interface that is suitable for both beginners and experienced traders. Upon logging in, you will be greeted with a clean and organized layout, with all the essential tools and features easily accessible. The platform is available in multiple languages, including English, Spanish, French, German, and more, catering to a diverse global user base.

The main dashboard provides a comprehensive overview of your trading account, including your account balance, open positions, and trading history. The navigation menu on the left-hand side allows you to access different sections of the platform, such as the trading interface, asset selection, and account settings. The platform also offers a search function, making it easy to find specific assets or features.

Section 2: Exploring the Asset Classes Available

IQ Option offers a wide range of asset classes for trading, allowing you to diversify your portfolio and take advantage of various market opportunities. Understanding the characteristics of each asset class is crucial for making informed trading decisions.

Stocks

Stocks are one of the most popular asset classes among traders. When trading stocks on the IQ Option platform, you are essentially speculating on the price movements of individual company shares. IQ Option offers a vast selection of stocks from various global exchanges, including companies such as Apple, Microsoft, Amazon, and more.

To trade stocks on IQ Option, you can choose to either buy or sell (short) stocks. Buying stocks allows you to profit from an increase in the stock's price, while selling stocks enables you to profit from a decline in the stock's price. IQ Option provides real-time stock charts, historical data, and fundamental analysis tools to assist you in making informed trading decisions.

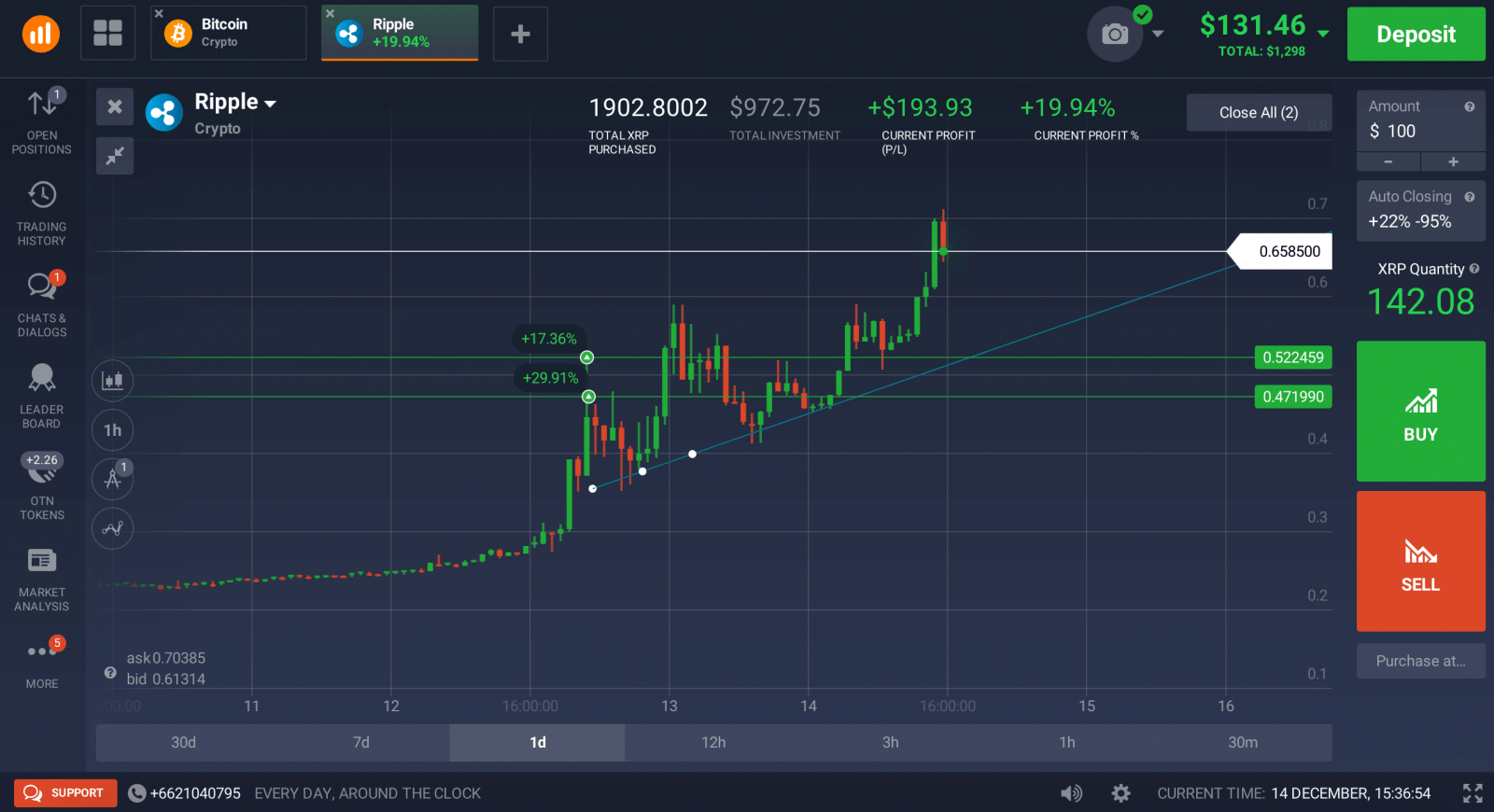

Cryptocurrencies

The rise of cryptocurrencies has revolutionized the financial industry, offering traders new opportunities for profit. IQ Option allows you to trade a variety of popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more. Cryptocurrency trading on IQ Option is conducted via CFDs (Contracts for Difference), which means that you do not own the actual cryptocurrency but rather speculate on its price movements.

Trading cryptocurrencies on IQ Option provides several advantages, including the ability to trade 24/7, high liquidity, and the potential for significant price volatility. The platform offers real-time cryptocurrency charts, technical analysis tools, and the option to set up price alerts to stay updated on market movements.

Forex

Forex (foreign exchange) trading involves the buying and selling of currencies. The forex market is the largest and most liquid financial market globally, with trillions of dollars being traded every day. IQ Option provides access to a wide range of currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

Forex trading on IQ Option allows you to profit from both rising and falling currency prices. The platform offers leverage, which enables you to multiply your trading capital and potentially amplify your profits. However, it's important to note that leverage also increases the risk of losses. IQ Option provides comprehensive forex charts, technical indicators, and economic calendars to assist you in analyzing the forex market and making informed trading decisions.

Commodities

Commodities are physical goods that can be bought and sold, such as gold, silver, oil, and agricultural products. Trading commodities on IQ Option provides a way to diversify your portfolio and take advantage of price movements in these markets. The platform offers a variety of commodities for trading, allowing you to speculate on their price fluctuations.

Commodity trading on IQ Option is conducted via CFDs, which means that you do not own the physical commodity but rather speculate on its price movements. The platform provides real-time commodity charts, technical analysis tools, and news updates to help you stay informed about market trends and make informed trading decisions.

Section 3: Analyzing the Tools and Indicators

IQ Option offers a range of tools and indicators to assist you in analyzing the markets and making informed trading decisions. These tools can be categorized into two main types: technical analysis tools and fundamental analysis tools.

Technical Analysis Tools

Technical analysis tools are used to analyze historical price data and identify patterns or trends that can help predict future price movements. IQ Option provides a comprehensive set of technical analysis tools, including:

Trend Lines

Trend lines are used to identify the direction of a price trend. They are drawn by connecting two or more significant price points on a chart. IQ Option allows you to draw trend lines manually or use the platform's automatic trend line tool.

Moving Averages

Moving averages are used to smooth out price fluctuations and identify the overall trend direction. IQ Option offers various types of moving averages, such as simple moving averages (SMA) and exponential moving averages (EMA). You can customize the period and color of the moving averages to suit your trading strategy.

Oscillators

Oscillators are used to identify overbought or oversold conditions in the market. They help traders anticipate potential trend reversals. IQ Option provides a range of popular oscillators, including the Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD).

Fundamental Analysis Tools

Fundamental analysis involves analyzing economic, financial, and geopolitical factors that can impact the value of an asset. IQ Option offers several fundamental analysis tools to help you stay informed about market events:

Economic Calendars

An economic calendar provides a schedule of important economic events, such as central bank announcements, GDP releases, and employment reports. IQ Option's economic calendar displays the date, time, and expected impact of each event, allowing you to plan your trades accordingly.

News Alerts

IQ Option provides real-time news alerts that keep you updated on the latest market developments. By staying informed about news events that can affect the markets, you can make better-informed trading decisions and capitalize on potential opportunities.

Section 4: Mastering Trading Strategies

Developing effective trading strategies is essential for success in the financial markets. In this section, we will explore some popular trading strategies that can be applied on the IQ Option platform.

Trend Following

Trend following is a strategy that aims to identify and capitalize on established trends in the market. Traders using this strategy look for assets that are consistently moving in one direction and enter positions in the direction of the trend. IQ Option's technical analysis tools, such as trend lines and moving averages, can assist in identifying and confirming trends.

Breakout Trading

Breakout trading involves entering a position when the price of an asset breaks through a significant support or resistance level. Traders using this strategy anticipate that the breakout will lead to a strong price movement in the direction of the breakout. IQ Option's technical analysis tools, such as trend lines and support/resistance levels, can help identify potential breakout opportunities.

Risk Management Techniques

Risk management is a crucial aspect of any trading strategy. IQ Option offers several risk management tools that can help you protect your capital and reduce the impact of potential losses:

Stop-Loss Orders

A stop-loss order is an instruction to close a position when the price reaches a certain level. By setting a stop-loss order, you can limit your potential losses if the market moves against your position. IQ Option allows you to set stop-loss orders when opening a trade or modify them for existing positions.

Take-Profit Orders

A take-profit order is an instruction to close a position when the price reaches a certain level of profit. By setting a take-profit order, you can secure your profits and exit the trade when your desired target is reached. IQ Option allows you to set take-profit orders when opening a trade or modify them for existing positions.

Position Sizing

Position sizing refers to determining the appropriate amount of capital to allocate to each trade based on your risk tolerance and trading strategy. IQ Option provides a risk management calculator that allows you to calculate the optimal position size based on your desired risk-reward ratio and stop-loss level.

Developing a Trading Plan

Having a well-defined trading plan is essential for consistent and disciplined trading. A trading plan outlines your trading goals, risk tolerance, entry and exit criteria, and rules for managing trades. IQ Option offers a trading journal where you can record and analyze your trades, helping you refine your trading plan over time.

Section 5: Exploring Advanced Features

In addition to its core trading features, IQ Option offers several advanced features that can enhance your trading experience and provide additional opportunities for profit.

Social Trading

Social trading allows you to follow and copy the trades of successful traders. IQ Option's social trading feature, known as "Copy Trading," lets you browse and select from a pool of top-performing traders and automatically replicate their trades in your account. This feature is especially beneficial for beginners or those who prefer a more hands-off approach to trading.

Mobile Trading

The IQ Option mobile app enables you to trade on the go, giving you access to the markets anytime, anywhere. The mobile app offers all the features and tools available on the desktop platform, allowing you to monitor your trades, analyze the markets, and execute trades from your smartphone or tablet.

Options Trading

IQ Option offers options trading, which provides traders with additional flexibility and potential profit opportunities. Options trading allows you to speculate on the price movements of an underlying asset without actually owning the asset. With options, you can trade both rising and falling markets and benefit from the leverage and limited risk that options provide.

Section 6: Managing Risks and Ensuring Security

Risk management and security are paramount when trading online. IQ Option implements several measures to ensure the safety of your funds and personal information.

Risk Management Techniques

In addition to the risk management tools mentioned earlier, it's crucial to establish a risk management strategy tailored to your individual trading style. This strategy may include diversifying your portfolio, setting realistic profit targets and stop-loss levels, and consistently monitoring and adjusting your trades.

Fund Protection

IQ Option takes the security of your funds seriously. Client funds are kept in segregated accounts, separate from the company's operational funds, ensuring that they are protected in the event of any financial difficulties. Additionally, IQ Option uses advanced encryption technology to secure your personal and financial information, keeping it safe from unauthorized access.

Two-Factor Authentication

To further enhance account security, IQ Option offers two-factor authentication (2FA). By enabling 2FA, you add an extra layer of protection to your account, requiring a unique verification code in addition to your password when logging in.

Section 7: Navigating the IQ Option Community

IQ Option provides a vibrant and supportive community for traders to interact, share ideas, and learn from each other. Engaging with the IQ Option community can enhance your trading journey and provide valuable insights.

IQ Option Blog

The IQ Option blog is a valuable resource that offers market insights, trading tips, and educational articles. Regularly checking the blog can help you stay updated on important market events, trading strategies, and platform updates.

Video Tutorials

IQ Option offers a wide array of video tutorials that cover various trading topics. These tutorials provide step-by-step guidance on using the platform, understanding technical indicators, and implementing trading strategies. Watching these videos can enhance your trading knowledge and skills.

Support Center

The IQ Option support center is available to assist you with any platform-related queries or technical issues. The support team can be reached via email or live chat, ensuring prompt and efficient assistance whenever you need it.

Section 8: Understanding Account Management

Efficient account management is crucial for long-term trading success. Understanding the various features and tools available for managing your IQ Option account can help you optimize your trading experience.

Deposit and Withdrawal Processes

IQ Option offers a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. Deposits are generally processed instantly, allowing you to fund your account quickly. Withdrawals are processed promptly, usually within 24 hours, ensuring timely access to your funds.

The IQ Option Demo Account

The IQ Option demo account is a valuable tool for beginners and experienced traders alike. The demo account allows you to practice trading using virtual funds, without risking your real money. It provides an opportunity to familiarize yourself with the platform, test different trading strategies, and gain confidence before trading with real funds.

Managing Emotions

Emotions can significantly impact trading decisions. It's crucial to manage emotions such as fear and greed, as they can lead to impulsive and irrational trading actions. Establishing a disciplined approach to trading, sticking to your trading plan, and avoiding impulsive trades can help you maintain emotional stability and make rational trading decisions.

Work-Life Balance

Trading can be time-consuming, and it's essential to maintain a healthy work-life balance. Set aside dedicated trading hours and avoid overtrading, as it can lead to fatigue and poor decision-making. Remember to take breaks, engage in hobbies, and spend time with loved ones to maintain a well-rounded lifestyle.

Section 9: Succeeding in IQ Option Competitions

IQ Option frequently hosts trading competitions, providing an opportunity for traders to showcase their skills and win attractive prizes. Participating in these competitions can be an exciting way to test your trading strategies and compete against other traders.

Types of Competitions

IQ Option offers various types of trading competitions, such as time-based competitions, profit-based competitions, and tournaments with specific trading instruments. Each competition has its own set of rules and prize structure, giving traders the flexibility to choose competitions that align with their trading style and preferences.

Strategies for Success

To increase your chances of success in IQ Option competitions, it's essential to develop a focused and disciplined trading approach. Some strategies for success include thorough analysis of market conditions, effective risk management, and capitalizing on short-term trading opportunities. Learning from previous competition winners and analyzing their strategies can also provide valuable insights.

Section 10: Staying Informed with IQ Option Educational Resources

IQ Option provides a wealth of educational resources to help traders stay informed and continuously improve their trading skills. These resources cover a range of topics and cater to traders of all experience levels.

Webinars

IQ Option regularly conducts webinars on various trading topics, including technical analysis, trading strategies, and market updates. These live webinars provide an interactive learning experience, allowing you to ask questions and interact with expert traders. Webinar recordings are also available for those who cannot attend the live sessions.

E-Books and Guides

IQ Option offers a collection of e-books and guides that cover a wide range of trading topics. These educational materials provide in-depth insights into trading strategies, technical analysis, risk management, and more. Reading these e-books can broaden your knowledge and provide valuable insights into the intricacies of trading.

Trading Tutorials

The IQ Option platform features a series of interactive tutorials that guide you through various aspects of trading. These tutorials cover topics such as placing trades, using technical indicators, and analyzing charts. Following these tutorials step by step can help you gain a solid understanding of how to navigate the platform and execute trades effectively.

In conclusion, the IQ Option trading platform offers a comprehensive suite of features and tools that can empower traders of all levels. By understanding the basics, exploring various asset classes, utilizing analytical tools and indicators, adopting effective trading strategies, managing risks, engaging with the community, and staying informed through educational resources, you can maximize your chances of success on the IQ Option platform. With dedication, practice, and continuous learning, you can embark on a rewarding trading journey and achieve your financial goals.

Related video of The Comprehensive Guide to the IQ Option Trading Platform

online trading stocks and options

Are you looking to venture into the exhilarating world of online trading stocks and options? Whether you are a seasoned investor or a newbie exploring the financial markets, this comprehensive guide is here to help you navigate through the intricacies of online trading. In this article, we will delve into the fundamentals, strategies, and best practices to equip you with the knowledge to make informed trading decisions.

Before diving into the exciting world of online trading, it is essential to understand the basics. We will start by explaining what stocks and options are, the key differences between them, and how they function within the financial markets. By grasping these foundational concepts, you will be able to approach trading with a clearer understanding of the mechanics behind it.

Getting Started with Online Trading

Choosing the Right Trading Platform

When it comes to online trading, selecting the right trading platform is crucial. A good trading platform should offer a user-friendly interface, real-time market data, advanced charting tools, and reliable order execution. It's important to research and compare different platforms to find one that suits your trading style and preferences.

Setting Up Your Account

Once you have chosen a trading platform, the next step is to set up your trading account. This typically involves providing your personal information, such as name, address, and social security number, to comply with regulatory requirements. Some platforms may also require additional documentation, such as proof of identity and address.

Understanding Account Types

Before you start trading, it's important to understand the different types of trading accounts available. Common types include cash accounts, margin accounts, and retirement accounts. Each account type has its own advantages and limitations, so it's crucial to choose one that aligns with your trading goals and risk tolerance.

Researching and Choosing Stocks and Options

Research is key when it comes to selecting stocks and options to trade. Fundamental analysis involves evaluating a company's financial health, industry trends, and competitive landscape to determine its potential for growth. Technical analysis, on the other hand, involves analyzing price patterns and indicators to identify entry and exit points. By combining both approaches, you can make more informed trading decisions.

Understanding Stocks: The Building Blocks of Trading

What Are Stocks?

Stocks, also known as shares or equities, represent ownership in a company. When you buy stocks, you become a shareholder and have the potential to profit from the company's success. Stocks can be classified into various types, including common stocks, preferred stocks, and penny stocks, each with its own characteristics and risks.

How Are Stocks Valued?

Stocks are valued based on several factors, including the company's financial performance, industry trends, and investor sentiment. Two common valuation methods used by investors are price-to-earnings (P/E) ratio and discounted cash flow (DCF) analysis. These methods help investors determine whether a stock is overvalued or undervalued.

Types of Stocks

There are different types of stocks available in the market, each with its own characteristics and risk profile. Common stocks are the most common type of stock and offer voting rights and potential dividends. Preferred stocks, on the other hand, offer fixed dividends but limited voting rights. Penny stocks are low-priced stocks that often trade on smaller exchanges and are considered more speculative.

Stock Exchanges and Marketplaces

Stocks are traded on various exchanges and marketplaces around the world. Some of the well-known stock exchanges include the New York Stock Exchange (NYSE), Nasdaq, and London Stock Exchange (LSE). In addition to traditional exchanges, there are also electronic marketplaces, such as the Over-the-Counter Bulletin Board (OTCBB) and Pink Sheets, where certain stocks are traded.

Exploring Options: An Introduction to Derivatives

What Are Options?

Options are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. Options are derivative contracts, meaning their value is derived from an underlying asset, such as stocks or commodities. They provide traders with additional flexibility and can be used for hedging or speculation.

Call Options vs. Put Options

There are two main types of options: call options and put options. Call options give the holder the right to buy the underlying asset, while put options give the holder the right to sell the underlying asset. Traders can use call options to profit from a rising market or put options to profit from a declining market.

Option Premium and Pricing

Options have an associated cost known as the option premium, which is influenced by various factors, including the price of the underlying asset, time to expiration, implied volatility, and interest rates. Options can be priced using various models, such as the Black-Scholes model, which takes these factors into account to determine the fair value of an option.

Option Strategies

Options offer a wide range of trading strategies, allowing traders to profit from different market conditions. Some common option strategies include buying or selling call/put options, covered calls, protective puts, and spreads. Each strategy has its own risk-reward profile and requires a thorough understanding of options and market dynamics.

Developing Your Trading Strategy: Fundamental and Technical Analysis

Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of an asset based on its underlying factors. For stocks, fundamental analysis includes assessing the company's financial statements, industry trends, competitive advantages, and management team. For options, fundamental analysis may involve analyzing the underlying stock and its potential impact on the option's value.

Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends that can help predict future price movements. Traders use various tools and indicators, such as moving averages, trendlines, and oscillators, to analyze price charts and make trading decisions. Technical analysis is particularly popular among short-term traders and day traders.

Combining Fundamental and Technical Analysis

While fundamental and technical analysis are often viewed as separate approaches, many traders combine both methods to gain a more comprehensive understanding of the markets. By considering both the fundamental factors driving the asset's value and the technical patterns indicating potential entry or exit points, traders can make more informed decisions.

Risk Management: Protecting Your Capital

Setting Stop-Loss Orders

A stop-loss order is a risk management tool that allows traders to set a predetermined exit point for their trades. By setting a stop-loss order, traders can limit their potential losses if the trade goes against them. It's important to determine an appropriate stop-loss level based on the asset's volatility and your risk tolerance.

Diversifying Your Portfolio

Diversification is a risk management strategy that involves spreading your investments across different assets, sectors, or geographical regions. By diversifying your portfolio, you can reduce the impact of any single investment's performance on your overall portfolio. This helps mitigate the risk of significant losses and potentially enhances long-term returns.

Position Sizing and Money Management

Position sizing refers to determining the appropriate size of each trade based on your risk tolerance and account size. Proper money management techniques, such as using a percentage of your account balance per trade, can help protect your capital and prevent excessive losses. It's crucial to establish a consistent money management plan and stick to it.

Understanding and Managing Leverage

Leverage can amplify both profits and losses in trading. It's important to understand the risks associated with leverage and use it judiciously. High leverage can lead to significant losses if the market moves against your position. Always consider the potential impact of leverage on your trading strategy and risk management plan.

The Psychology of Trading: Mastering Your Emotions

Overcoming Fear and Greed

Fear and greed are common emotions that can cloud judgment and lead to poor trading decisions. Fear can prevent traders from taking calculated risks, while greed can push them to chase profits without proper analysis. It's important to recognize these emotions and develop strategies to mitigate their influence on your trading decisions.

Staying Disciplined and Patient

Discipline and patience are essential qualities for successful trading. This involves sticking to your trading plan, following your risk management rules, and not allowing impulsive decisions to interfere with your strategy. Avoiding emotional trading and maintaining a long-term perspective can help you stay focused and make rational decisions.

Learning from Mistakes

Mistakes are part of the learning process in trading. It's important to analyze and learn from your mistakes rather than repeating them. Keeping a trading journal can help you identify recurring patterns and areas for improvement. Embrace mistakes as opportunities for growth and continuously strive to refine your trading skills.

Seeking Support and Education

Seeking Support and Education

Trading can be a solitary endeavor, but it doesn't mean you have to go it alone. Seek support from fellow traders, join online communities or forums, and participate in trading groups where you can share experiences and learn from others. Additionally, investing in your education through books, courses, and webinars can provide valuable insights and help you stay updated with the latest trends and strategies.

Maintaining Emotional Balance

Trading can be emotionally challenging, especially during periods of market volatility or when facing unexpected losses. It's crucial to develop strategies to maintain emotional balance. This could include practicing mindfulness or relaxation techniques, taking breaks from trading when needed, and focusing on long-term goals rather than short-term fluctuations.

Building Confidence

Confidence plays a vital role in trading success. Building confidence comes with experience and knowledge. Continuously educate yourself, practice your strategies, and evaluate your performance to build a solid foundation of skills and understanding. Celebrate your wins and learn from your losses to boost your confidence and belief in your trading abilities.

Best Practices for Online Trading

Stay Informed with Market Trends

To make informed trading decisions, it's important to stay updated with market trends and news. Follow reputable financial news sources, subscribe to newsletters or market analysis reports, and utilize economic calendars to keep track of important events that may impact the markets. This information can help you identify potential trading opportunities.

Develop a Trading Plan

A trading plan is a roadmap that outlines your trading goals, strategies, risk management rules, and criteria for entering and exiting trades. Having a well-defined trading plan helps you maintain discipline and consistency in your approach. Regularly review and revise your trading plan as needed to adapt to changing market conditions.

Manage Your Time Effectively

Online trading can be time-consuming, especially if you are actively monitoring the markets. It's important to manage your time effectively to avoid burnout and ensure a healthy work-life balance. Set specific trading hours, utilize automation tools, and prioritize tasks to optimize your trading efficiency and productivity.

Practice Patience and Avoid FOMO

Patience is a virtue in trading. Avoid the fear of missing out (FOMO) by waiting for high-probability trading opportunities that align with your strategy. Avoid impulsive trades driven by emotions or the desire to chase quick profits. Remember, successful trading is about consistency and following a well-thought-out approach.

Keep a Trading Journal

Maintaining a trading journal is a valuable practice for self-reflection and improvement. Record your trades, including entry and exit points, reasons for taking the trade, and the outcome. Analyze your journal periodically to identify patterns, strengths, and weaknesses in your trading. This can help you refine your strategies and make adjustments to improve your performance.

Choosing the Right Brokerage: Factors to Consider

Consider Your Trading Needs and Goals

When choosing a brokerage, it's important to consider your specific trading needs and goals. Are you a beginner looking for educational resources? Do you require advanced trading tools and research capabilities? Assess your requirements and choose a brokerage that aligns with your objectives.

Evaluate Trading Fees and Commissions

Trading fees and commissions can vary significantly among brokerages. Consider the cost structure of different brokers, including account maintenance fees, trade commissions, and margin interest rates. Factor in your trading volume and frequency to determine the impact of fees on your overall trading profitability.

Assess Trading Platform and Tools

The trading platform provided by a brokerage should be user-friendly, stable, and offer the features and tools you need for your trading style. Look for advanced charting capabilities, real-time market data, order types, and customization options. Some brokers also offer mobile trading apps, which can be convenient for on-the-go trading.

Research Customer Support and Reputation

Customer support is an important aspect to consider, especially if you are a beginner or require assistance with technical issues. Research the reputation of the brokerage, read reviews from other traders, and evaluate the level of customer support provided. Prompt and reliable customer service can greatly enhance your trading experience.

Check Security Measures and Regulatory Compliance

Ensure that the brokerage you choose has robust security measures in place to protect your personal and financial information. Look for brokers that are regulated by reputable financial authorities, as this provides an additional layer of protection. Regulatory compliance ensures that the brokerage operates within industry standards and follows ethical practices.

Advanced Trading Strategies: Going Beyond the Basics

Options Spreads and Strategies

Options spreads involve trading multiple options contracts simultaneously to create unique risk-reward profiles. Strategies such as bull spreads, bear spreads, and iron condors allow traders to profit from different market conditions and manage risk more effectively. Understanding and implementing options spreads can enhance your trading strategies.

Utilizing Technical Indicators and Oscillators

Technical indicators and oscillators can provide valuable insights into market trends and potential reversals. Explore popular indicators such as moving averages, relative strength index (RSI), and stochastic oscillators to identify overbought or oversold conditions, confirm price patterns, and generate trading signals.

Implementing Algorithmic Trading

Algorithmic trading, also known as automated or black-box trading, involves using computer programs to execute trades based on predefined rules and algorithms. This approach can help remove emotions from trading and allow for faster execution. Understand the basics of algorithmic trading and explore platforms or tools that can facilitate its implementation.

Using Options for Hedging and Income Generation

Options can be powerful tools for hedging existing positions or generating additional income. Strategies such as covered calls, protective puts, and cash-secured puts can help mitigate downside risk and potentially enhance overall portfolio returns. Learn how to effectively use options in combination with your existing positions for risk management and income generation.

Staying Informed: Resources for Continued Learning

Books on Trading and Investing

Books are a great resource for expanding your knowledge and gaining insights from experienced traders and investors. Explore titles such as "A Random Walk Down Wall Street" by Burton Malkiel, "Reminiscences of a Stock Operator" by Edwin Lefèvre, or "Options, Futures, and Other Derivatives" by John C. Hull. These books cover a wide range of trading and investing topics.

Financial Websites and Blogs

There are numerous financial websites and blogs that provide valuable market analysis, trading strategies, and educational content. Explore reputable sources such as Investopedia, Seeking Alpha, or The Motley Fool for in-depth articles and analysis. Subscribe to newsletters or follow industry experts to stay up-to-date with the latest market trends.

Online Courses and Webinars

Online courses and webinars offer structured learning opportunities for traders of all levels. Platforms like Udemy, Coursera, and Skillshare offer courses on various trading topics, including technical analysis, options trading, and algorithmic trading. Attend webinars hosted by industry professionals or brokerage firms for insights and trading techniques.

Financial News Channels and Podcasts

Financial news channels like CNBC, Bloomberg, or Fox Business provide real-time market updates, interviews with experts, and analysis of economic events. Additionally, podcasts such as "Chat With Traders," "The Investors Podcast," or "The Option Alpha Podcast" offer interviews with successful traders and insights into their strategies and experiences.

In conclusion, online trading stocks and options can be a rewarding endeavor if approached with the right knowledge and strategies. By understanding the basics, developing a robust trading plan, managing risk effectively, and staying disciplined, you can increase your chances of success in the dynamic world of online trading. Remember, continuous learning and adapting to market conditions are key to staying ahead in this exciting industry.

Related video of The Ultimate Guide to Online Trading Stocks and Options: Everything You Need to Know

virtual trading account free

Are you interested in exploring the world of trading but hesitant to risk your hard-earned money? Look no further – virtual trading accounts offer a risk-free environment for beginners and seasoned traders alike. In this blog article, we will delve into the concept of virtual trading accounts, discussing their benefits, how to open one, and how to make the most of your virtual trading experience.

Whether you are a novice trader looking to gain hands-on experience or a seasoned investor looking to test new strategies, virtual trading accounts provide a valuable learning platform. With no real money at stake, you can explore the ins and outs of trading, analyze market trends, and refine your skills without any financial risk. Let's dive into the details and discover how you can make the most of these free virtual trading accounts.

Understanding Virtual Trading Accounts

If you are new to trading, it's essential to understand what virtual trading accounts are and how they differ from real trading accounts. Virtual trading accounts, also known as paper trading accounts, are simulated trading platforms that allow you to practice trading without using real money. These accounts are typically offered by brokerage firms or online trading platforms and provide you with a virtual balance that you can use to place trades.